On March 20, 2024, the Saskatchewan’s Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 2 sections:

- Business Tax

- Personal Tax

Personal tax changes

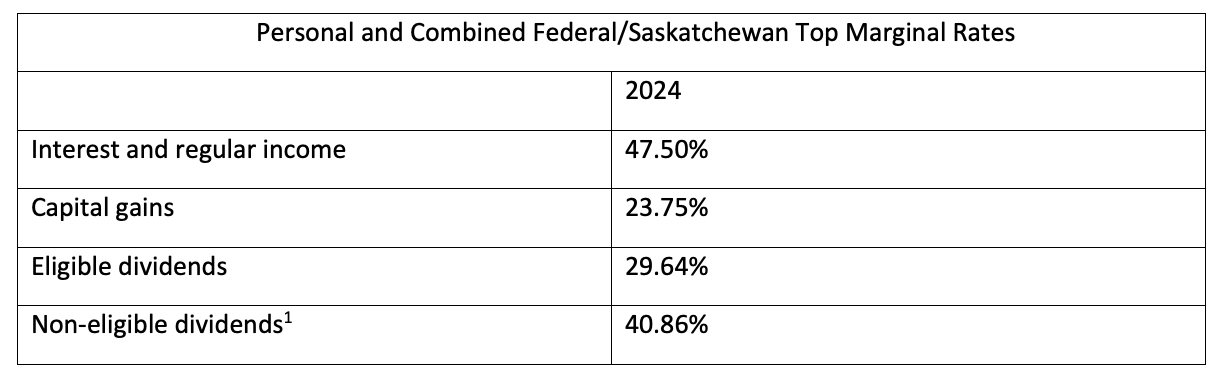

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, the Saskatchewan’s personal income tax rate remains as follows:

1 The top marginal tax rate on non-eligible dividends is scheduled to decrease to 40.37% for 2025 (assuming no further rate or dividend tax credit changes.)

Business tax changes

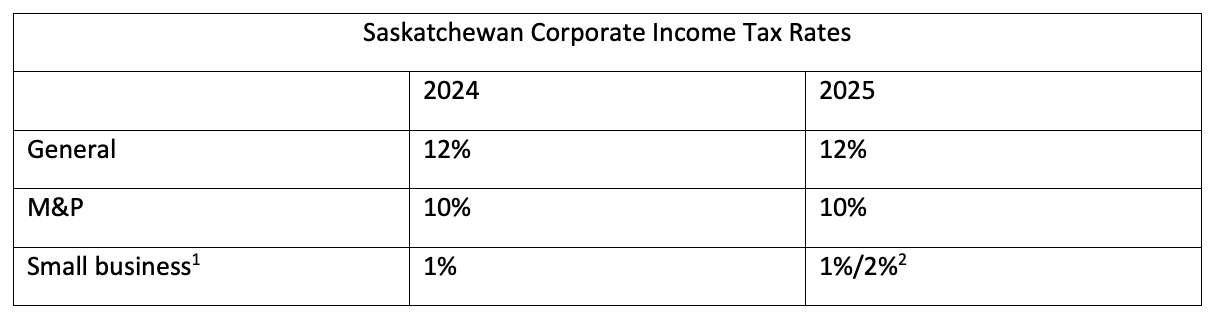

The budget delays a planned increase in the 1% small business income tax rate until July 1, 2025. This means that instead of going up on July 1, 2024, the small business tax rate will only increase to 2% on July 1, 2025. This change also affects Saskatchewan’s corporate income tax rates, which are set to be as follows:

1 On first $600,000 of active business income.

2 Saskatchewan’s small business tax rate is scheduled to increase to 2% on July 1, 2025.

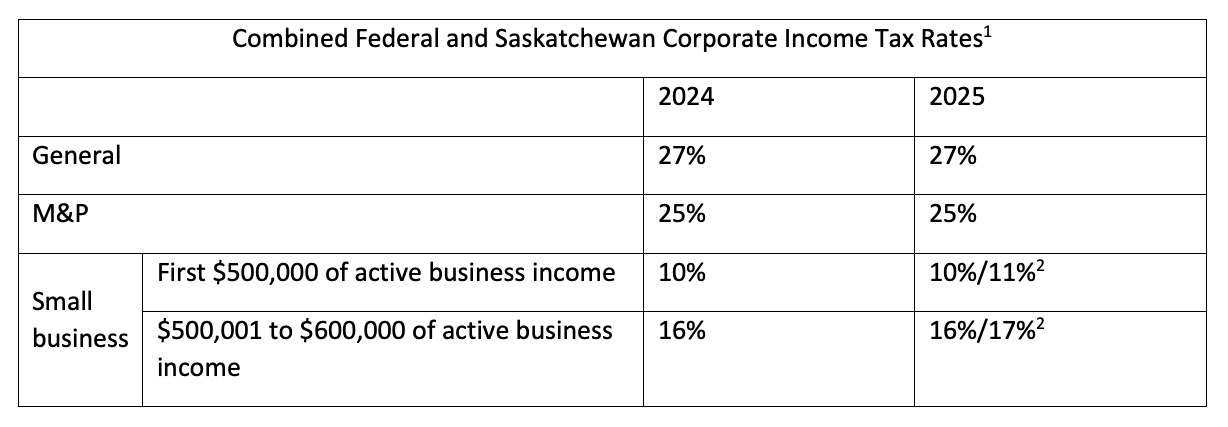

Also, the total Saskatchewan and federal corporate income tax rates are set to be:

.png)

1 Assuming no further changes to federal or Saskatchewan tax rates.

2 Saskatchewan’s small business tax rate is scheduled to increase to 2% on July 1, 2025.

Saskatchewan Technology Start-up Incentive

The budget improves the Saskatchewan Technology Start-up Incentive. This program gives a non-refundable 45% tax credit to specific accredited investors who invest in certain start-up businesses. Now, the budget makes more start-ups eligible for this incentive, especially those working on new technologies in clean energy. Plus, the program will last longer, until March 31, 2027, instead of March 31, 2026. Also, there will be more money available for funding these start-ups.

Saskatchewan Commercial Innovation Incentive

The budget gives more time for businesses to apply for the Saskatchewan Commercial Innovation Incentive, also known as the “patent box.” Now, businesses can apply until June 30, 2025, instead of June 30, 2024. This incentive typically lowers the provincial corporate income tax rate to 6% for ten years for businesses that sell their new ideas in Saskatchewan. Also, the government plans to check how well this program is working in 2024 and will listen to what businesses have to say about it.

Critical Minerals Innovation Incentive

The budget brings in the Saskatchewan Critical Minerals Innovation Incentive, a new program. It’s for certain pilot and growing projects that get transferable Crown royalty and freehold production tax credits. These credits are worth 25% of the costs of the program that qualifies. The budget mentions that this incentive is for projects that use new technologies to improve how minerals are recovered, reduce environmental effects, add value during processing, or sell extra or waste products.

Critical Minerals Processing Investment Incentive

The budget brings in the Critical Minerals Processing Investment Incentive. This program gives transferable Crown royalty and freehold production tax credits. These credits amount to 15% of eligible costs for certain projects. The incentive is for new or expanded projects that add value to minerals in Saskatchewan. It includes opportunities to sell extra products made at current mines and processing plants.

Saskatchewan Petroleum Innovation Incentive

The budget gives more time to apply for the Saskatchewan Petroleum Innovation Incentive, now until March 31, 2029, instead of March 31, 2024. This incentive gives transferable tax credits for certain projects that turn innovative ideas into business reality. The credits amount to 25% of the costs of the project that qualifies. The budget also stops helium and lithium projects from being eligible for this incentive because they can now qualify under the new Saskatchewan Critical Minerals Innovation Incentive.

Oil and Gas Processing Investment Incentive

The budget gives more time for the Oil and Gas Processing Investment Incentive until March 31, 2029, instead of March 31, 2024. Also, there’s more funding available. This incentive offers transferable tax credits for certain projects that add value to the oil and gas industry, whether they’re new projects or improving existing ones. The credits amount to 15% of the costs of the project that qualifies. The budget also stops helium and lithium projects from being eligible for this incentive because they can now qualify under the new Critical Minerals Processing Investment Incentive.

Multi-lateral Well Program

The budget starts the Multi-lateral Well Program, which gives drilling incentives for certain new oil wells. The incentives depend on whether the well is shallow, deep, or for exploring. This program is for new wells drilled from April 1, 2024, to March 31, 2028.

We can help!

Wondering how this year’s budget will impact your finances or your business? We can help – give us a call today!

Source: https://budget.saskatchewan.ca/